4 Ways Miami Businesses Get Fast Funding

4 Ways Miami Businesses Get Fast Funding

Running a business in Miami means dealing with ups and downs. One month you're swamped with orders, the next month clients are paying late. Or maybe you found the perfect piece of equipment but need money fast before someone else gets it.

Here's the thing - traditional banks move slow. Really slow. By the time they approve your loan, the opportunity is gone or your problem got worse.

That's why smart Miami business owners use these four funding options instead.

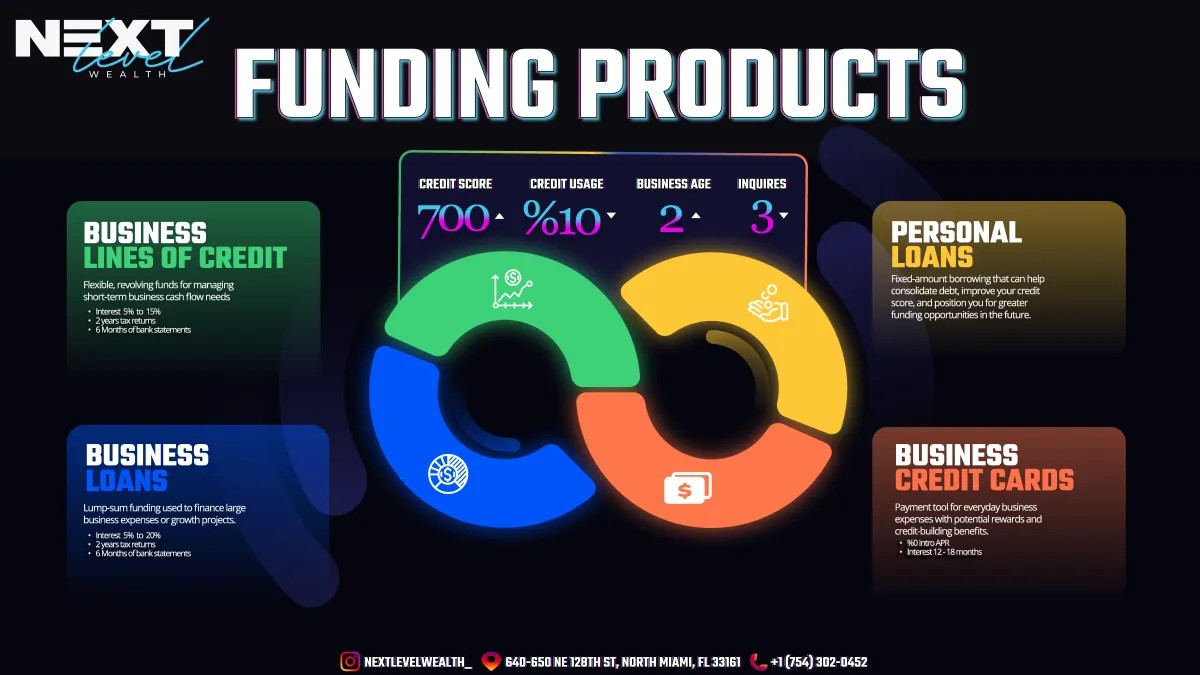

1. Business Lines of Credit

Think of this as your business safety net. You get approved for a credit limit - say $50,000 - but you don't pay anything until you use it. Need $5,000 to cover payroll this month? Use it. Pay it back when your big client finally pays you.

The best part? You only pay interest on what you actually use. So if you have a $50,000 line but only use $5,000, you only pay interest on the $5,000.

Good for: Covering payroll gaps, buying inventory before busy season, handling surprise expenses.

2. Business Loans

When you need a chunk of money for something specific, business loans make sense. You get the full amount upfront and pay it back over time with fixed monthly payments.

These work great when you know exactly what you need the money for and how much it costs. New delivery truck? Equipment for expansion? Business loan.

Good for: Buying equipment, renovating your space, hiring employees, any big business expense.

3. Business Credit Cards

Don't overlook these. Many business credit cards come with 0% interest for the first 12-18 months. That's basically free money if you can pay it off during that time.

Plus, they help you build business credit history, which makes it easier to get bigger loans later. And you'll separate your business expenses from personal ones - your accountant will thank you.

Good for: Daily business expenses, online subscriptions, business travel, anything you buy regularly.

4. Personal Loans

Sometimes the fastest way to fund your business is through a personal loan. Yeah, it's not "business funding" but it works. Especially if you're just starting out or your business credit isn't great yet.

Personal loans can also help you consolidate high-interest debt, which improves your credit score. Better credit score means better business funding options later.

Good for: Starting a new business, bridging gaps while waiting for business funding, paying off credit cards.

What You Need to Qualify

Most lenders want to see:

Credit score of 700+

Less than 10% credit usage

Business operating for 2+ years

No more than 3 recent credit inquiries

Don't have perfect credit? There are still options. It just depends on your situation.

Which Option Makes Sense?

Need money available anytime? → Business Line of Credit

Have a specific big purchase? → Business Loan

Want to earn rewards on daily spending? → Business Credit Card

Building credit or just starting out? → Personal Loan

The Real Talk About Funding

Here's what most people don't tell you - every business needs access to money. Cash flow problems kill more businesses than bad products or lazy employees.

The successful Miami businesses we work with don't wait until they're desperate to set up funding. They get approved when times are good, so the money is there when they need it.

Think about it - when do you think you'll get better loan terms? When your business is doing great and you don't desperately need the money? Or when you're behind on rent and scrambling?

Smart business owners get their funding lined up before they need it.

What's Next?

If you're thinking "yeah, this makes sense but I don't know where to start" - that's normal. Most business owners don't deal with lenders every day.

That's where we come in. We work with multiple lenders to find you the best deal. No running around to different banks. No confusing paperwork. Just straight answers about what you qualify for and what it'll cost.

Want to see what funding options are available for your business? Give us a call at (754) 302-0452 or stop by our North Miami office. We'll look at your numbers and tell you what options you have.

Because the last thing your business needs is to miss out on opportunities because you didn't have access to money.